Download the PHP package taxjar/taxjar-php without Composer

On this page you can find all versions of the php package taxjar/taxjar-php. It is possible to download/install these versions without Composer. Possible dependencies are resolved automatically.

Download taxjar/taxjar-php

More information about taxjar/taxjar-php

Files in taxjar/taxjar-php

Package taxjar-php

Short Description Sales Tax API Client for PHP 8.0+

License MIT

Homepage https://www.taxjar.com/

Informations about the package taxjar-php

TaxJar Sales Tax API for PHP

Official PHP client for Sales Tax API v2. For the REST documentation, please visit https://developers.taxjar.com/api.

Requirements

Installation

Authentication

Usage

Custom Options

Sandbox Environment

Error Handling

Testing

Requirements

- PHP 8.0 and later.

- Guzzle (included via Composer).

Installation

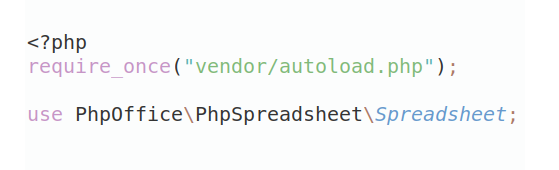

Use Composer and add taxjar-php as a dependency:

If you get an error with composer require, update your composer.json directly and run composer update.

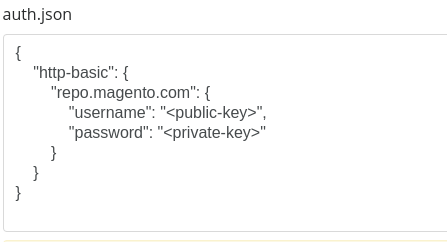

Authentication

You're now ready to use TaxJar! Check out our quickstart guide to get up and running quickly.

Usage

categories - List all tax categories

taxForOrder - Calculate sales tax for an order

listOrders - List order transactions

showOrder - Show order transaction

createOrder - Create order transaction

updateOrder - Update order transaction

deleteOrder - Delete order transaction

listRefunds - List refund transactions

showRefund - Show refund transaction

createRefund - Create refund transaction

updateRefund - Update refund transaction

deleteRefund - Delete refund transaction

listCustomers - List customers

showCustomer - Show customer

createCustomer - Create customer

updateCustomer - Update customer

deleteCustomer - Delete customer

ratesForLocation - List tax rates for a location (by zip/postal code)

nexusRegions - List nexus regions

validateAddress - Validate an address

validate - Validate a VAT number

summaryRates - Summarize tax rates for all regions

List all tax categories (API docs)

The TaxJar API provides product-level tax rules for a subset of product categories. These categories are to be used for products that are either exempt from sales tax in some jurisdictions or are taxed at reduced rates. You need not pass in a product tax code for sales tax calculations on product that is fully taxable. Simply leave that parameter out.

Calculate sales tax for an order (API docs)

Shows the sales tax that should be collected for a given order.

List order transactions (API docs)

Lists existing order transactions created through the API.

Show order transaction (API docs)

Shows an existing order transaction created through the API.

Create order transaction (API docs)

Creates a new order transaction.

Update order transaction (API docs)

Updates an existing order transaction created through the API.

Delete order transaction (API docs)

Deletes an existing order transaction created through the API.

List refund transactions (API docs)

Lists existing refund transactions created through the API.

Show refund transaction (API docs)

Shows an existing refund transaction created through the API.

Create refund transaction (API docs)

Creates a new refund transaction.

Update refund transaction (API docs)

Updates an existing refund transaction created through the API.

Delete refund transaction (API docs)

Deletes an existing refund transaction created through the API.

List customers (API docs)

Lists existing customers created through the API.

Show customer (API docs)

Shows an existing customer created through the API.

Create customer (API docs)

Creates a new customer.

Update customer (API docs)

Updates an existing customer created through the API.

Delete customer (API docs)

Deletes an existing customer created through the API.

List tax rates for a location (by zip/postal code) (API docs)

Shows the sales tax rates for a given location.

Please note this method only returns the full combined rate for a given location. It does not support nexus determination, sourcing based on a ship from and ship to address, shipping taxability, product exemptions, customer exemptions, or sales tax holidays. We recommend using

taxForOrderto accurately calculate sales tax for an order.

List nexus regions (API docs)

Lists existing nexus locations for a TaxJar account.

Validate an address (API docs)

Validates a customer address and returns back a collection of address matches. Address validation requires a TaxJar Plus subscription.

Validate a VAT number (API docs)

Validates an existing VAT identification number against VIES.

Summarize tax rates for all regions (API docs)

Retrieve minimum and average sales tax rates by region as a backup.

This method is useful for periodically pulling down rates to use if the TaxJar API is unavailable. However, it does not support nexus determination, sourcing based on a ship from and ship to address, shipping taxability, product exemptions, customer exemptions, or sales tax holidays. We recommend using

taxForOrderto accurately calculate sales tax for an order.

Sandbox Environment

You can easily configure the client to use the TaxJar Sandbox:

For testing specific error response codes, pass the custom X-TJ-Expected-Response header:

Custom Options

Timeout

This package utilizes Guzzle which defaults to a request timeout value of 0s, allowing requests to remain pending for an indefinite period of time.

You can modify this behavior by configuring the client with a

timeoutvalue in seconds.

API Version

By default, TaxJar's API will respond to requests with the latest API version when a version header is not present on the request.

To request a specific API version, include the

x-api-versionheader with the desired version string.

Error Handling

When invalid data is sent to TaxJar or we encounter an error, we’ll throw a TaxJar\Exception with the HTTP status code and error message. To catch these exceptions, refer to the example below:

For a full list of error codes, click here.

Testing

Make sure PHPUnit is installed via composer install and run the following:

To enable debug mode, set the following config parameter after authenticating: