Download the PHP package netopia/paymentsv2 without Composer

On this page you can find all versions of the php package netopia/paymentsv2. It is possible to download/install these versions without Composer. Possible dependencies are resolved automatically.

Download netopia/paymentsv2

More information about netopia/paymentsv2

Files in netopia/paymentsv2

Package paymentsv2

Short Description The Payments API was designed and implemented by NETOPIA Payments development team and is meant to be used in third party applications to cover the payment process.

License Apache-2.0

Informations about the package paymentsv2

Introduction

The NETOPIA Payment PHP library provides easy access to the NETOPIA Payments API from applications written in the PHP language.

Compatible

PHP 5.7.x - 8.0.x

API Documention

API Specification

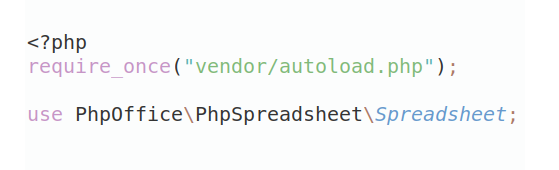

Installation

To install the library via composer, run the following command:

- composer require netopia/paymentsv2

Or add "netopia/paymentsv2": "^1.0.0" to the "require" section in composer.json

API Actions

Start

Use this endpoint to start a payment. Based on the response to this call the process either stops or you need to continue with verify_auth

- Endpoint: /payment/card/start

- Method:

POST -

Param type: JSON

- Param structure: The JSON as parameter has tree main part

- Config: to set configiguraton section of a transaction

- Payment: to set payment method and card informations of a transaction

- Order: to set order details for a transction

- Param structure: The JSON as parameter has tree main part

-

Sandbox URL:

https://secure.sandbox.netopia-payments.com/payment/card/start // Start endpoint URL - Sandbox

-

Live URL:

https://secure.mobilpay.ro/pay/payment/card/start // Start endpoint URL - Live

-

Steps for start

-

1) Define setting

-

2) Make start json request

- Sample JSON:

-

3) Send your request

-

Sample Start response:

The response of START endpoint, will be a Json with following structure

-

-

4) Analyzing Error Code

To continue payment progress, you will need to verify the error code in your app

Error codes

-

100 : Requires 3-D Secure authentication

-

56 : duplicated Order ID

-

99 : There is another order with a different price

-

19 : Expire Card Error

-

20 : Founduri Error

-

21 : CVV Error

-

22 : CVV Error

-

34 : Card Tranzactie nepermisa Error

- 0 : Card has no 3DS

Status codes

- 15 : need authorize

- 3 : is paid

- 5 : is confirmed

Note

Error Code 100 & Status 15, means you need to do Authorize the transaction via Bank first (3DS) Error Code 0 & Status 3, means your job is done.

Base on other Error code you can handle the progress of payment .

-

-

5) Authorize 3D card

What to send

Find parameters to send from response of previous action on data -> formData

How to send

For authorize of 3D card, you will need to send a HTTP request via Form by POST method to Bank authentication URL.

WHere to send

you have the Bank authentication URL from response of previous action on data -> customerAction -> url

-

6) Verify authentication

To verify authentication you will need to send the request to verify-auth end point,

- Action URL: /payment/card/verify-auth

- Method:

POST - Param type: JSON

- Params:

- authenticationToken: The unique authentication token, from start action

- ntpID: The transaction id from start action

- paRes: The DATA from client's bank

- Params:

Example of verify-auth setting

make verify-auth json request

send verify-auth json request

Json ex. of verify-auth response

verify-auth action response

The response of verify-auth endpoint, will be a Json with following structure

Regarding the error code & the status you will be able to manage the messages & the actions on your Site / App after the success or failed payments in 3DS

What is 3DS

3DS is a security protocol used to authenticate users / card holders.

-

What kind of data need to be collected for 3DS

To have benefit of 3DS need to be collected some simple data of the User's device, what they used it to make the payments

Like : OS name, OS version, IP, ...