Download the PHP package shopblocks-engineering/omnipay-sagepay without Composer

On this page you can find all versions of the php package shopblocks-engineering/omnipay-sagepay. It is possible to download/install these versions without Composer. Possible dependencies are resolved automatically.

Download shopblocks-engineering/omnipay-sagepay

More information about shopblocks-engineering/omnipay-sagepay

Files in shopblocks-engineering/omnipay-sagepay

Package omnipay-sagepay

Short Description Sage Pay driver for the Omnipay PHP payment processing library

License MIT

Homepage https://github.com/thephpleague/omnipay-sagepay

Informations about the package omnipay-sagepay

Omnipay: Sage Pay

Sage Pay driver for the Omnipay PHP payment processing library

Omnipay is a framework agnostic, multi-gateway payment processing library for PHP. This package implements Sage Pay support for Omnipay. This version supports PHP ^7.3 and PHP ^8.

This is the master branch of Omnipay, handling Omnipay version 3.x.

For the 2.x branch, please visit https://github.com/thephpleague/omnipay-sagepay/tree/2.x

Table of Contents

- Omnipay: Sage Pay

- Installation

- Basic Usage

- Supported Methods

- Sage Pay Direct Methods

- Direct Authorize/Purchase

- Redirect (3D Secure)

- Redirect Return

- Direct Create Card

- Direct Authorize/Purchase

- Sage Pay Server Methods

- Server Gateway

- Server Authorize/Purchase

- Server Create Card

- Server Notification Handler

- Sage Pay Form Methods

- Form Authorize

- Form completeAuthorize

- Form Purchase

- Sage Pay Shared Methods (Direct and Server)

- Repeat Authorize/Purchase

- Capture

- Delete Card

- Sage Pay Direct Methods

- Token Billing

- Generating a Token or CardReference

- Using a Token or CardReference

- Basket format

- Sage 50 Accounts Software Integration

- Account Types

- VAT

- Support

- References

Installation

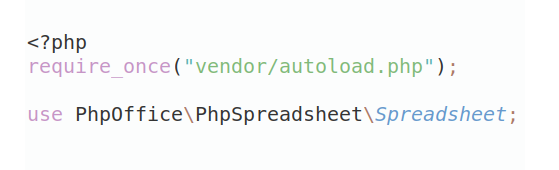

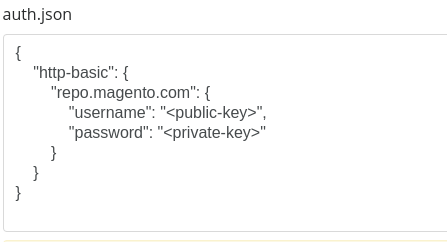

Omnipay is installed via Composer.

To install, simply add it to your composer.json file:

And run composer to update your dependencies:

$ curl -s http://getcomposer.org/installer | php

$ php composer.phar updateBasic Usage

The following gateways are provided by this package:

- SagePay_Direct

- SagePay_Server

- SagePay_Form

For general Omnipay usage instructions, please see the main Omnipay repository.

Supported Methods

Sage Pay Direct Methods

Sage Pay Direct is a server-to-server protocol, with all credit card details needing to pass through your application for forwarding on to the gateway. You must be aware of the PCI implications of handling credit card details if using this API.

The Direct gateway methods for handling cards are:

authorize()- with completeAuthorize for 3D Secure and PayPal redirectpurchase()- with completePurchase for 3D Secure and PayPal redirectcreateCard()- explicit "standalone" creation of a cardReference or token

Note: PayPal is not yet implemented in this driver.

Direct Authorize/Purchase

At this point you will have either a final result or a redirect.

If $responseMessage->isSuccessful() is true, then the authorization is

complete and successful. If false then check for a redirect, otherwise

the authorization was not successful.

Redirect (3D Secure)

If the authorization result is a redirect, then a quick and dirty way to redirect is:

That redirect() method is intended just for demonstration or testing.

Create your own instead, within your framework, using these helpers:

$responseMessage->getRedirectUrl()$responseMessage->getRedirectMethod()$responseMessage->getRedirectData()

Redirect Return

After the user has performed their 3D Secure authentication, they will

be redirected (via POST) back to your returnUrl endpoint.

The transaction is not yet complete.

It must be completed like this:

The $transactionId (same as created for the original purchase())

is only needed if you want to save getTransactionReference()

for future repeat payments.

The normal getters will be available here to check the result,

get the cardReference for saving etc.

Direct Create Card

This will create a card reference with no authorization.

If you want to authorize an amount on the card and get a cardReference

for repeated use of the card, then use the authorize() method with the

createToken flag set.

Sample code using Sage Pay Direct to create a card reference:

Sage Pay Server Methods

Sage Pay Server captures any credit card details in forms hosted by the Sage Pay gateway, either by sending the user to the gateway or loading the hosted forms in an iframe. This is the preferred and safest API to use.

Sage Pay Server uses your IP address to authenticate backend access to the gateway, and it also needs to a public URL that it can send back-channel notifications to. This makes development on a localhost server difficult.

authorize()purchase()createCard()- explicit "standalone" creation of a cardReference or tokenacceptNotification()- Notification Handler for authorize, purchase and explicit cardReference registration

Server Gateway

All Sage Pay Server methods start by creating the gateway object, which we

will store in $gateway here. Note there are no secrets or passwords that need

to be set, as the gateway uses your server's IP address as its main method of

authenticating your application.

The gateway object is minimally created like this:

Server Authorize/Purchase

This method authorizes a payment against a credit or debit card.

A cardToken or cardReference previously captured, can be used here, and only

the user's CVV will be asked for, but the overall flow will remain the same.

The $creditCard object will provide the billing and shipping details:

- The country must be a two-character ISO 3166 code.

- The state will be a two-character ISO code, and is mandatory if the country is "US".

- The state will be ignored if the country is not "US".

- Address2 is optional, but all other fields are mandatory.

- The postcode is optional for Republic of Ireland "IE", though some banks insist it is present and valid.

- This gateway lives on an extended ASCII ISO 8859-1 back end. Really. Do any characterset conversions in your merchant site to avoid surprises.

- Both billing and shipping name and address is required.

However, you can use the

billingForShippingflag to set the shipping details to what you supply as the billing details.

Server Create Card

When creating a cardReference, for Sage Pay Server the reference will be available only in the notification callback.

Sample code using Sage Pay Server to create a card reference:

At this point the user will be redirected to enter their CC details.

The details will be held by the gateway and a token sent to the notification

handler, along with the transactionId.

The notification handler needs to store the cardReference or token referenced by

the transactionId then acknowledge the acceptance and provide a final URL the user

is taken to.

If using an iframe for the hosted credit card form, then on return to the final redirect URL (provided by the notification handler) it is your site's responsibility to break out of the iframe.

Server Notification Handler

NOTE: The notification handler was previously handled by the SagePay_Server

completeAuthorize,completePurchaseandcompleteRegistrationmethods. The notification handler replaces all of these.

The SagePay_Server gateway uses a notification callback to receive the results of a payment or authorization.

Sage Pay Direct does not use the notification handler.

Unlike many newer gateways, this notification handler is not just an optional callback providing an additional channel for events. It is required for the Server gateway, and not used for the direct gateway at all.

The URL for the notification handler is set in the authorize or payment message:

Your notification handler needs to do four things:

- Look up the saved transaction in the database to retrieve the

securityKey. - Validate the signature of the received notification to protect against tampering.

- Update your saved transaction with the results.

- Respond to Sage Pay to indicate that you accept the result, reject the result or don't believe the notification was valid. Also tell Sage Pay where to send the user next.

This is a back-channel (server-to-server), so has no access to the end user's session.

The acceptNotification gateway is set up simply.

The $request will capture the POST data sent by Sage Pay:

Your original transactionId is available to look up the transaction in the database:

Now the signature can be checked:

If you were not able to look up the transaction or the transaction is in the wrong state, then indicate this with an error. Note an "error" is to indicate that although the notification appears to be legitimate, you do not accept it or cannot handle it for any reason:

Note: it has been observed that the same notification message may be sent by Sage Pay multiple times. If this happens, then return the same response you sent the first time. So if you have confirmed a successful payment, then if you get another identical notification for the transaction, then return

confirm()again.

If you accept the notification, then you can update your local records and let Sage Pay know:

The $nextUrl is where you want Sage Pay to send the user to next.

It will often be the same URL whether the transaction was approved or not,

since the result will be safely saved in the database.

The confirm(), error() and reject() methods will all echo the expected

return payload and expect your application to return a HTTP Status 200

without adding any further content.

These functions used to exit the

application immediately to prevent additional output being added to

the response. You can restore this functionality by setting the exitOnResponse

option:

If you just want the body payload, this method will return it without

echoing it.

You must return it with a 200 HTTP Status Code:

Sage Pay Form Methods

Sage Pay Form requires neither a server-to-server back-channel nor

IP-based security.

It does not require pre-registration of a transaction, so is ideal for

a speculative "pay now" button on a page for instant purchases of a

product or service.

Unlike Direct and Server, it does not support saved card references

or tokens.

The payment details are encrypted on the server before being sent to the gateway from the user's browser. The result is returned to the merchant site also through a client-side encrypted message.

Capturing and voiding Form transactions is a manual process performed

in the "My Sage Pay" administration panel.

Supported functions are:

authorize()purchase()

Form Authorize

The authorization is intialized in a similar way to a Server payment,

but with an encryptionKey:

The encryptionKey is generated in "My Sage Pay" when logged in as the administrator.

Note that this gateway driver will assume all input data (names, addresses etc.) are UTF-8 encoded. It will then recode the data to ISO8859-1 before encrypting it for the gateway, since the gateway strictly accepts ISO8859-1 only, regardless of what encoding is used to submit the form from the merchant site. If you do not want this conversion to happen, it can be disabled with this parameter:

'disableUtf8Decode' => true,The authorize must be given a returnUrl (the return URL on success, or on failure

if no separate failureUrl is provided).

The $response will be a POST redirect, which will take the user to the gateway.

At the gateway, the user will authenticate or authorize their credit card,

perform any 3D Secure actions that may be requested, then will return to the

merchant site.

Like Server and Direct, you can use either the DEFERRED or the AUTHENTICATE

method to reserve the amount.

Form completeAuthorize

To get the result details, the transaction is "completed" on the

user's return. This will be at your returnUrl endpoint:

Note that if send() throws an exception here due to a transactionId mismatch,

you can still access the decryoted data that was brought back with the user as

$completeRequest->getData().

You will need to log this for later analysis.

If you already have the encrypted response string, then it can be passed in. However, you would normally leave it for the driver to read it for you from the current server request, so the following would not normally be necessary:

$crypt = $_GET['crypt']; // or supplied by your framework

$result = $gateway->completeAuthorize(['crypt' => $crypt])->send();This is handy for testing or if the current page query parameters are not available in a particular architecture.

It is important to make sure this result is what was expected by your merchant site. Your transaction ID will be returned in the result and can be inspected:

$result->getTransactionId()You must make sure this transaction ID matches the one you sent the user off with in the first place (store it in your session). If they do no match, then you cannot trust the result, as the user could be running two checkout flows at the same time, possibly for wildly different amounts.

In a future release, the completeAuthorize() method will expect the

transactionId to be supplied and it must match before it will

return a success status.

Form Purchase

This is the same as authorize(), but the purchase() request is used instead,

and the completePurchase() request is used to complete the transaction on return.

Sage Pay Shared Methods (Direct and Server)

Note: these functions do not work for the Form API.

These actions for Sage Pay Form must be performed manually through the "My Sage Pay"

admin panel.

capture()refund()void()- void a purchaseabort()- abort an authorization before it is capturedrepeatAuthorize()- new authorization based on past transactionrepeatPurchase()- new purchase based on past transactiondeleteCard()- remove a cardReference or token from the account

Repeat Authorize/Purchase

An authorization or purchase can be created from a past authorization or purchase.

You will need the transactionReference of the original transaction.

The transactionReference will be a JSON string containing the four pieces of

information the gateway needs to reuse the transaction.

Capture

If the useAuthenticate parameter was set when the transaction was originally

authorized, then it must be used in the capture too.

- Setting the

useAuthenticateparameter will cause the capture to send anAUTHORISErequest. You must supply anamount, adescriptionand a newtransactionIdwhen doing this. You can capture multiple amounts up to 115% of the originalAUTHENTICATED(with 3D Secure) orREGISTERED(without 3D Secure) amount. - Resetting the

useAuthenticateparameter (false, the default mode) will cause the capture to send aRELEASErequest. This will release the provided amount (up to the original deferred amount, but no higher) that was originallyDEFERRED. You can only capture a deferred payment once, then the deferred payment will be closed.

Examples of each:

In both cases, send the message and check the result.

Delete Card

This is one of the simpler messages:

Token Billing

Sage Pay Server and Direct support the ability to store a credit card detail on the gateway, referenced by a token, for later use or reuse. The token can be single-use, or permanently stored (until its expiry date or explicit removal).

Whether a token is single-use or permanent, depends on how it is used, and not on how it is generated. This is important to understand, and is explained in more detail below.

Generating a Token or CardReference

A token can be generated explicitly, with no authorization, or it can be generated as a part of a transaction:

$gateway->createCard()- message used to create a card token explicitly/standalone.$request->setCreateToken()- transaction option to generate a token with the transaction.

If created explicitly, then a CVV can be provided, and that will be stored against the token until the token is first used to make a payment. If the cardReference is reused after the first payment, then a CVV must be supplied each time (assuming your rules require the CVV to be present). If using Sage Pay Server, then the user will be prompted for a CVV on subsequent uses of the cardReference.

If creating a token or cardReference with a transaction, then the CVV will never be

stored against the token.

The transaction response (or notification request for Sage Pay Server) will provide the generated token. This is accessed using:

$response->getToken()or$response->getCardReference()

These are equivalent since there is no difference in the way tokens or cardRererences are generated.

Using a Token or CardReference

To use a token with Sage Pay Direct, you must leave the credit card details blank in

the CreditCard object. Sage Pay Server does not use the credit card details anyway.

To use the token as a single-use token, add it to the transaction request like this:

request->setToken($saved_token);

Once authorized, this token will be deleted by the gateway and so cannot be used again. Note that if the transaction is not authorized, then the token will remain. You should then delete the token explicitly to make sure it does not remain in the gateway (it will sit there until the card expires, maybe for several years).

To use the token as a permanent cardReference, add it to the transaction request like this:

request->setCardReference($saved_token);

This CardReference will remain active on the gateway whether this transaction is authorized or not, so can be used multiple times.

Basket format

Sagepay currently supports two different formats for sending cart/item information to them:

These are incompatible with each other, and cannot be both sent in the same transaction.

BasketXML is the most recent format, and is the default used by this driver.

Basket is an older format which may be deprecated one day,

but is also the only format currently supported by some of the Sage accounting products

(e.g. Line 50) which can pull transaction data directly from Sage Pay.

For applications that require this type of integration, an optional parameter useOldBasketFormat

with a value of true can be passed in the driver's initialize() method.

Sage 50 Accounts Software Integration

The Basket format can be used for Sage 50 Accounts Software Integration:

It is possible to integrate your Sage Pay account with Sage Accounting products to ensure you can reconcile the transactions on your account within your financial software. If you wish to link a transaction to a specific product record this can be done through the Basket field in the transaction registration post. Please note the following integration is not currently available when using BasketXML fields. In order for the download of transactions to affect a product record the first entry in a basket line needs to be the product code of the item within square brackets. For example:

You can either prepend this onto the description or using \Omnipay\SagePay\Extend\Item you can use setProductCode

which will take care of pre-pending [] for you.

Account Types

Your Sage Pay account will use separate merchant accounts for difference transaction sources.

The sources are specified by the accountType parameter, and take one of three values:

- "E" Omnipay\SagePay\Message\AbstractRequest::ACCOUNT_TYPE_E (default)

For ecommerce transactions, entered in your application by the end user. - "M" Omnipay\SagePay\Message\AbstractRequest::ACCOUNT_TYPE_M

MOTO transactions taken by telephone or postal forms or faxes, entered by an operator. The operator may ask for a CVV when taking a telephone order. - "C" Omnipay\SagePay\Message\AbstractRequest::ACCOUNT_TYPE_C

For repeat transactions, generated by the merchant site without any human intervention.

The "M" MOTO and "C" account types will also disable any 3D-Secure validation that may otherwise be triggered. The "C" account type will disable any CVV requirement.

The "account type" is common across other gateways, but often with different names. Authorize.Net calls it the "business model" and includes "retail" as an option, linking to card machines and hand-held scanners. This is not yet standardized in Omnipay, but there are some moves to do so.

VAT

If you want to include VAT amount in the item array you must use

\Omnipay\SagePay\Extend\Item as follows.

Support

If you are having general issues with Omnipay, we suggest posting on Stack Overflow. Be sure to add the omnipay tag so it can be easily found.

If you want to keep up to date with release announcements, discuss ideas for the project, or ask more detailed questions, there is also a mailing list which you can subscribe to.

If you believe you have found a bug, please report it using the GitHub issue tracker, or better yet, fork the library and submit a pull request.