Download the PHP package infoodle/hmrc-gift-aid without Composer

On this page you can find all versions of the php package infoodle/hmrc-gift-aid. It is possible to download/install these versions without Composer. Possible dependencies are resolved automatically.

Download infoodle/hmrc-gift-aid

More information about infoodle/hmrc-gift-aid

Files in infoodle/hmrc-gift-aid

Package hmrc-gift-aid

Short Description A library for charities and CASCs to claim Gift Aid (including Small Donations) from HMRC

License GPL-3.0-or-later

Homepage https://github.com/infoodle/hmrc-gift-aid

Informations about the package hmrc-gift-aid

HMRC (Gift Aid) Charity Repayment Claims

A library for charities and CASCs to claim Gift Aid (including Small Donations) from HMRC

'Gift Aid' is a UK tax incentive that enables tax-effective giving by individuals to charities in the United Kingdom. Gift Aid increases the value of donations to charities and Community Amateur Sports Clubs (CASCs) by allowing them to reclaim basic rate tax on a donor's gift.

'HMRC Charity Repayment Claims' is a library for submitting Gift Aid claims to HMRC.

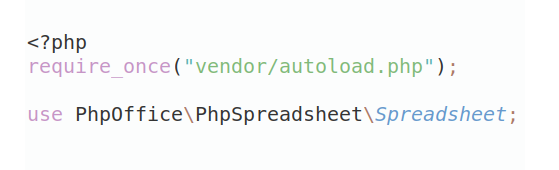

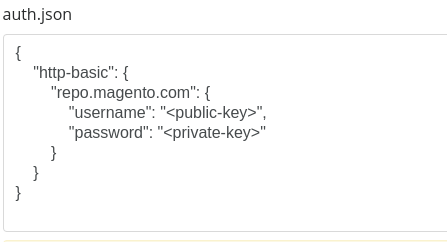

Installation

The library can be installed via Composer. To install, simply add

it to your composer.json file:

And run composer to update your dependencies:

$ curl -s http://getcomposer.org/installer | php $ php composer.phar update

Test

composer run testEnable Xdebug locally to see coverage data. This should still run with a note about the configuration and no coverage stats if it's missing.

Some notes on the library and Data Persistance

From the introduction to the IRMark Specification:

There is legislation in place that states that in the case of a civil dispute between the Inland Revenue (IR) and a taxpayer with regards to an Internet online submission, the submission held by the Inland Revenue is presumed to be correct unless the taxpayer can prove otherwise. In other words the burden of proof is on the taxpayer. There is therefore a requirement to enable the IR Online services and software that uses the services to provide a mechanism to aid a taxpayer to prove whether or not the submission held by IR is indeed the submission they sent.

That is a very roundabout way of saying the XML that you submit must include a signature of some sort. The signature can be used to prove that what the HMRC received is actually what you intended to send. HMRC will, in their turn, include a similar signature in any responses they send to you. In the case of submissions to the HMRC Government Gateway, this signature is the IRmark (pronounced IR Mark).

It is strongly recommended that both the XML that you send and the XML that you receive should be stored in case there is any dispute over the claim - be that a dispute over the submission of the claim or over the content of the claim itself.

This library will generate the appropriate IRmark signature for all outgoing messages and check the IRmark on all incoming messages. This library, however, does not attempt to store or in any way persist any data whatsoever. This means that your application will need to store a number of pieces of information for use during dispute resolution. Having said that, it is not necessary to store ALL messages sent to or received from the gateway. The following is a recommended set of data to be stored by your application.

-

HMRC Correlation ID This will be generated by HMRC when you send your request and returned in all subsequent messages. You will also need to supply this correlation ID when submitting any messages or queries related to the claim. While it is not essential to store this, I do recommend it.

-

The Claim Request The communication protocol requires a number of messages to be exchanged in the course of a claim submission. I recommend storing only the initial claim request as this is the message that will contain all the claim data. Other messages simply facilitate the assured delivery of that initial message.

- The Claim Response This is not necessarily the first message you get back after sending your Request - there will be polling and other protocol messages first. HMRC will first verify the validity of the submitted claim (note this is verifying that the structure of the message is valid and that the data conforms to the required standards). Once this is done you will receive a response message with an acknowledgement similar to this:

See the sample source code below to see how and where to extract the above data from the library.

Basic Usage

Preparing your data

The first thing you need is to identify both the organisation(s) and the individual submitting the Gift Aid claim.

The Vendor data identifies the company and software product used to submit the claims. Each

vendor is assigned a Vendor ID and is required to identify the software that will submit the

claims. To obtain an ID, please see the

Charities Online Service Recognition Process.

The Authorised Official is an individual within the organisation (Charity or CASC) that

has been previously identified to HMRC as having the authority to submit claims on behalf of

the organisation. That individual will register for an account to log in to Charities Online

and the user ID and password are required when submitting claims. The additional data sent

with the claim - name and contact details - must be consistent with that held by HMRC.

Each Charity or CASC that is registered with HMRC will have two identifiers. The first is the

Charity ID which is a number issued by HMRC when registering as a charity. The second is the

Charities Commission Reference which is issued by the relevant charity regulator. We also

need to know which regulator the charity is registered with.

Finally, you will need to build a list of all donations for which you want to claim a Gift Aid repayment. For each donation you will also need to know the name and last known address of the donor.

And now that you have all the data you need, you can submit a claim.

Preparing to send a request

This applies to all cases below. Whenever you need to send something to HMRC you will need to prepare the gaService object as shown here.

Submitting a new claim

Once you have prepared the gaService object and collected your donations and donor data, you are ready to send the claim.

Submitting adjustments with a claim

If you submit a claim and then subsequently need to reverse or refund a donation for which you have already claimed Gift Aid, you will need to submit an adjustment with your next claim. The adjustment value is set to the value of the refund you have already been paid for the refunded donation. In other words if you claim Gift Aid on a £100.00 donation you will be paid £25.00 by HMRC. If you subsequently refund that £100.00 you submit an adjustment to HMRC for the £25.00.

Prepare the gaService object and your claim items as usual, but before calling giftAidSubmit

add the adjustment as shown below.

Querying a previously submitted claim

Prepare the gaService object in the usual way and then call requestClaimData. This will

return a list of all previously submitted claims with status. It's a good idea to delete older

claim records - if nothing else it prevents having to download them all every time you need to

call requestClaimData.

More Information

For more information on the Gift Aid scheme as it applies to Charities and Community Amateur Sports Clubs, and for information on Online Claim Submission, please see the Gov website.

For information on developing and testing using HMRC Document Submission Protocol, please see Charities repayment claims support for software developers.

All versions of hmrc-gift-aid with dependencies

ext-dom Version *

ext-simplexml Version *

ext-xmlwriter Version *

ext-zlib Version *

infoodle/php-govtalk Version ^1.0.0-beta4