Download the PHP package academe/omnipay-authorizenetapi without Composer

On this page you can find all versions of the php package academe/omnipay-authorizenetapi. It is possible to download/install these versions without Composer. Possible dependencies are resolved automatically.

Download academe/omnipay-authorizenetapi

More information about academe/omnipay-authorizenetapi

Files in academe/omnipay-authorizenetapi

Package omnipay-authorizenetapi

Short Description Authorize.Net payment gateway driver for the Omnipay 3.x payment processing library

License MIT

Homepage https://github.com/academe/omnipay-authorizenetapi

Informations about the package omnipay-authorizenetapi

Table of Contents

- Table of Contents

- Omnipay-AuthorizeNetApi

- Installation

- Authorize.Net API

- API Authorize/Purchase (Credit Card)

- API Capture

- API Authorize/Purchase (Opaque Data)

- API Void

- API Refund

- API Fetch Transaction

- Hosted Payment Page

- Hosted Payment Page Authorize/Purchase

- Webhook Notifications

Omnipay-AuthorizeNetApi

Omnipay 3.x implementation of Authorize.Net API

Installation

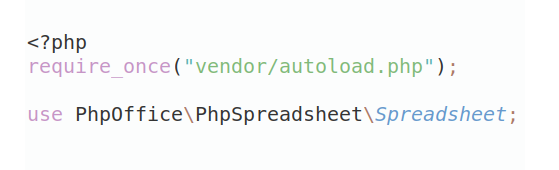

composer require "academe/omnipay-authorizenetapi: ~3.0"Authorize.Net API

The Authorize.Net API driver handles server-to-server requests. It is used both for direct card payment (though check PCI requirements) and for creating transactions using a card token generated client-side.

API Authorize/Purchase (Credit Card)

The following example is a simple authorize with supplied card details. You would normally avoid allowing card details near your merchant site back end for PCI compliance reasons, supplying a tokenised card reference instead (see later section for this).

API Capture

Once authorized, the amount can be captured:

API Authorize/Purchase (Opaque Data)

The "Opaque Data" here is a tokenised credit or debit card.

Authorize.Net can tokenise cards in a number of ways, one of which

is through the accept.js package on the front end.

It works like this:

You build a payment form in your page. As well as hard-coding it as shown below, the gateway provides a method you can use to generate it dynamically.

Note the card detail elements do not have names, so will not be submitted to your site. This is important for PCI reasons. Two hidden fields are defined to carry the opaque data to your site. You can include as many other fields as you like in the same form, which may include a name and an address.

After the payment form, you will need the accept.js JavaScript:

Use the https://js.authorize.net/v1/Accept.js URL for production.

You need to catch the "Pay Now" submission and send it to a function to

process the card details. Either an onclick attribute or a jQuery event

will work. For example:

<button type="button" onclick="sendPaymentDataToAnet()">Pay</button>The sendPaymentDataToAnet function handles the tokenisation.

The response handler is able to provide errors that may have been

generated while trying to tokenise the card.

But if all is well, it updates the payment form with the opaque data

(another function paymentFormUpdate):

Populate the opaque data hidden form items, then finally submit the form:

Back at the server, you will have two opaque data fields to capture:

- opaqueDataDescriptor

- opaqueDataValue

Initiate an authorize() or purchase() at the backend, as described in

the previous section. In the creditCard object, leave the card details

blank, not set. Instead, send the opaque data:

or

or join with a colon (:) to handle as a card token:

The authorize or purchase should then go ahead as though the card details were provided directly. In the result, the last four digits of the card will be made available in case a refund needs to be performed.

Further details can be found in the official documentation.

Note also that the opaque data is used for other payment sources, such as bank accounts and PayPal.

API Void

An authorized transaction can be voided:

API Refund

A cleared credit card payment can be refunded, given the original transaction reference, the original amount, and the last four digits of the credit card:

API Fetch Transaction

An existing transaction can be fetched from the gateway given

its transactionReference:

The Hosted Payment Page will host the payment form on the gateway. The form can be presented to the user as a full page redirect or in an iframe.

Hosted Payment Page

The Hosted Payment Page is a different gateway:

The gateway is configured the same way as the direct API gateway,

and the authorize/purchase

requests are created in the same way, except for the addition of

return and cancel URLs:

Hosted Payment Page Authorize/Purchase

The response will be a redirect, with the following details used to construct the redirect in the merchant site:

A naive POST "pay now" button may look like the following form.

This will take the user to the gateway payment page, looking something like this by default:

The billing details will be prefilled with the card details supplied

in the $gateway->authorize().

What the user can change and/or see, can be changed using options or

confiration in the account.

Taking the hostedPaymentPaymentOptions as an example,

this is how the options are set:

The documentation

lists hostedPaymentPaymentOptions as supporting these options:

{"cardCodeRequired": false, "showCreditCard": true, "showBankAccount": true}

To set any of the options, drop the hostedPayment prefix from the options

name, then append with the specific option you want to set, and use the

result as the parameter, keeping the name in camelCase.

So the above set of options are supported by the following parameters:

- paymentOptionsCardCodeRequired

- paymentOptionsShowCreditCard

- paymentOptionsShowBankAccount

You can set these in the authorize() stage:

or use the set*() form to do the same thing:

$request->setPaymentOptionsShowBankAccount(false);Webhook Notifications

The Authorize.Net gateway provides a rich set of webhooks to notify the merchant site (and/or other backend systems) about events related to customers or payments. The current documentation can be found here.

For some API methods, such as the Hosted Payment Page, the webhooks are necessary for operation. For other API methods they provide additional information.

The webhooks can be configured in the Authorize.Net account settings page. They can also be fully managed through a REST API, so that a merchant site can register for all the webhooks that it needs. Note that the webhook management RESTful API has not yet been implemented here.

Your notification handler is set up like this at your webhook endpoint:

This will read and parse the webhook POST data.

The raw nested array data can be found at:

$notification->getData();The parsed Notification value object can be found at:

$notification->getParsedData();Some details that describe the nature of the notification are:

See here for a full list of the target, subtarget and actions: https://github.com/academe/authorizenet-objects/blob/master/src/ServerRequest/Notification.php#L24

For those notifications that contain the transactionReference, this can be

obtained:

$notification->getTransactionReference();For any notifications that do not involve a transaction, this will be null.

Note that the webhook does not include the merchant transactionId,

so there is nothing to tie the payment webhook back to a Hosted Page request.

In this case, you can supply the transactionId as a query parameter

on the notifyUrl when creating the Hosted Payment Page data.

However, do be aware this ID will be visible to end users monitoring

browser traffic, and the ID (being in the URL) will not be included

in the notification signing, so could be faked. It is unlikely, but just

be aware that it is a potential attack vector, so maybe self-sign the URL

too.

Notifications can be signed by the gateway using a signatureKey.

By default, this notification handler will verify the signature

and throw an exception if it failes to validate against the key

you provide when fetching the result of the transaction.

A manual check of the signature can be made using:

$notification->isSignatureValid()This will return true if the signature is valid, or false if any

part of the verification process fails.

Validation of the signature can be disabled if needed:

$gateway->setDisableWebhookSignature(true);For consistency with other Omipay Drivers, this driver may make an

opinionated decision on how the transactionId is passed into the

notification handler, but only after researchign how other people are

handling it.

There is a front-end way to do it through an iframe, but it seems

vulnerable to user manipulation to me.

All versions of omnipay-authorizenetapi with dependencies

academe/authorizenet-objects Version ~0.7

symfony/property-access Version ^3.2 || ^4.0