Libraries tagged by Redirect Customer

bitexpert/magento2-force-customer-login

381375 Downloads

The Force Login module for Magento2 redirects a storefront visitor to the Magento2 Frontend login page, if the visitor is not logged in. It is possible to configure the whitelisted urls to add custom definitions.

opengento/module-country-store-redirect

3703 Downloads

This module will redirect the customers regarding their country of origin, on their first visit session.

opengento/module-country-store-switcher

4225 Downloads

This module will allows the customers to switch of store by country instead of name/language.

briqpay/php-sdk

11003 Downloads

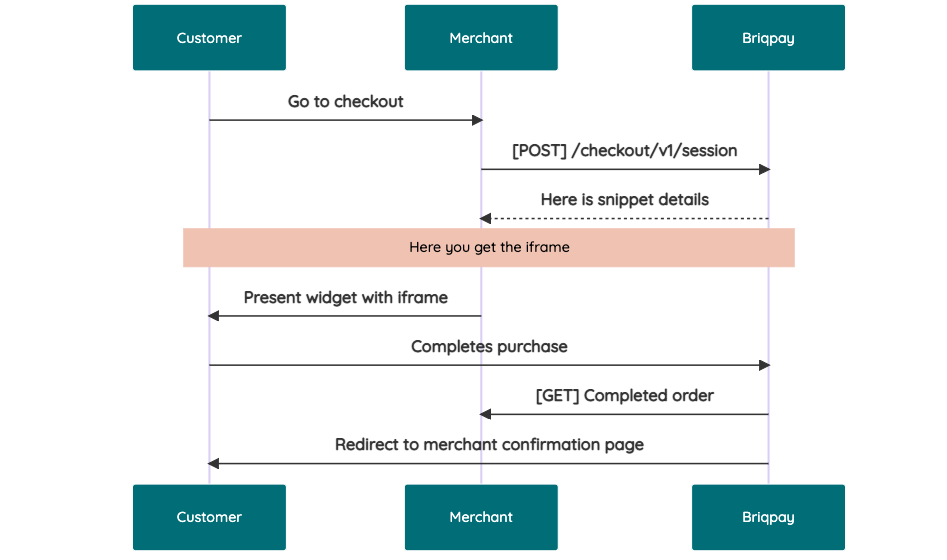

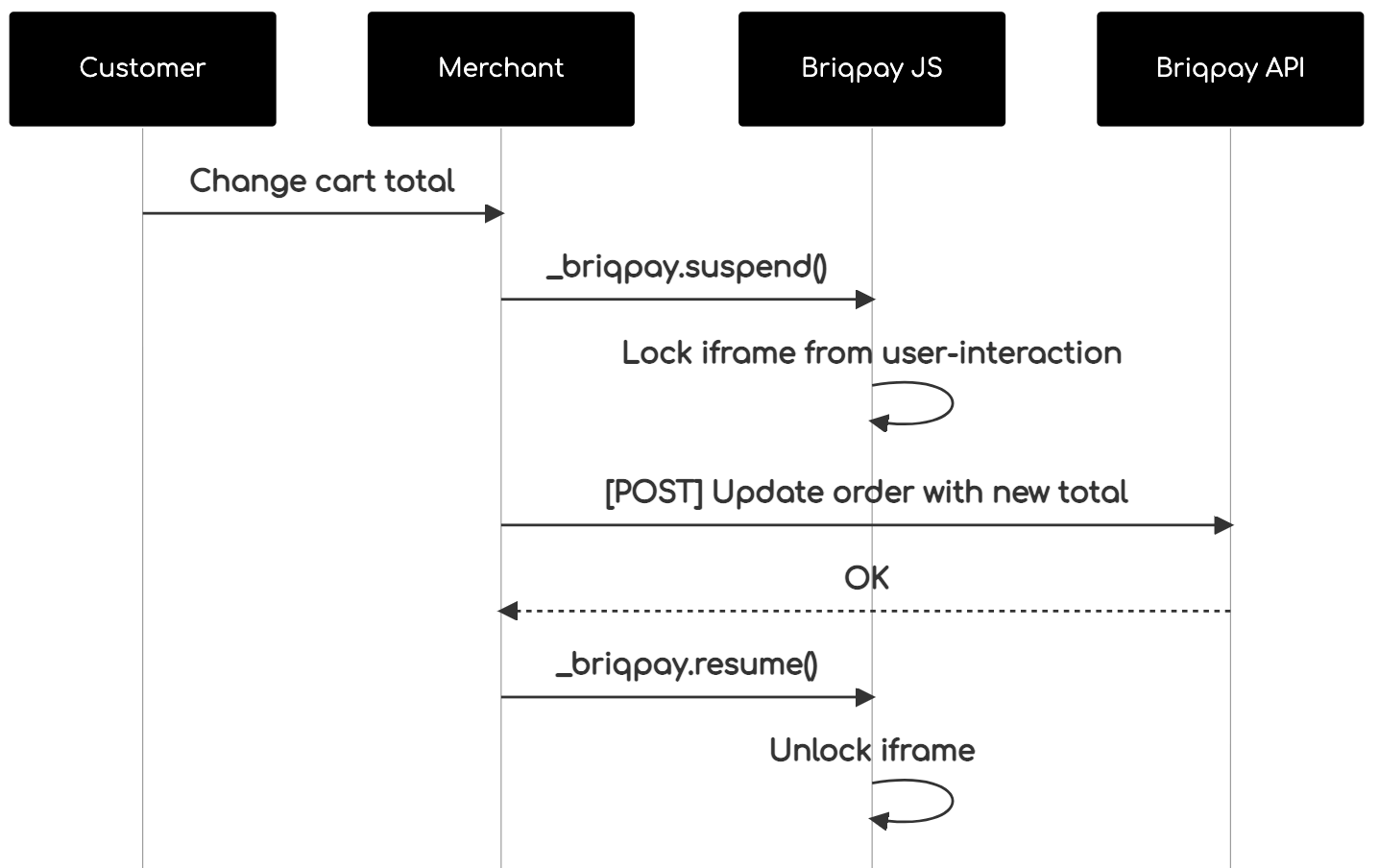

This is the API documentation for Briqpay. You can find out more about us and our offering at our website [https://briqpay.com](https://briqpay.com) In order to get credentials to the playgrund API Please register at [https://app.briqpay.com](https://app.briqpay.com) # Introduction Briqpay Checkout is an inline checkout solution for your b2b ecommerce. Briqpay Checkout gives you the flexibility of controlling your payment methods and credit rules while optimizing the UX for your customers # SDKs Briqpay offers standard SDKs to PHP and .NET based on these swagger definitions. You can download them respively or use our swagger defintitions to codegen your own versions. #### For .NET `` Install-Package Briqpay `` #### For PHP `` composer require briqpay/php-sdk `` # Standard use-case As a first step of integration you will need to create a checkout session. \n\nIn this session you provide Briqpay with the basic information necessary. In the response from briqpay you will recieve a htmlsnippet that is to be inserted into your frontend. The snippet provided by briqpay will render an iframe where the user will complete the purchase. Once completed, briqpay will redirect the customer to a confirmation page that you have defined.  # JavaScript SDK The first step of integration is to add our JS to your site just before closing the ```` tag. This ensures that our JS library is avaliable to load the checkout. ```` Briqpay offers a few methods avaliable through our Javascript SDK. The library is added by our iframe and is avalable on ``window._briqpay`` If you offer the posibility to update the cart or order amonts on the checkout page, the JS library will help you. If your store charges the customer different costs and fees depening on their shipping location, you can listen to the ``addressupdate``event in order to re-calculate the total cost. ```javascript window._briqpay.subscribe('addressupdate', function (data) { console.log(data) }) ``` If your frontend needs to perform an action whe the signup has completed, listen to the ``signup_finalized`` event. ```javascript window._briqpay.subscribe('signup_finalized', function (status) { // redirect or handle status 'success' / 'failure' }) ``` If you allow customers to change the total cart value, you can utilise the JS library to suspend the iframe while you perform a backen update call towards our services. As described below:  The iframe will auto-resume after 7 seconds if you dont call ``_briqpay.resume()`` before # Test Data In order to verify your integration you will neeed to use test data towards our credit engine. ## Company identication numbers * 1111111111 - To recieve a high credit scoring company ( 100 in rating) * 2222222222 - To test the enviournment with a bad credit scoring company (10 in rating) ## Card details In our playground setup your account is by default setup with a Stripe integration. In order to test out the card form you can use the below card numbers: * 4000002500003155 - To mock 3ds authentication window * 4000000000000069 Charge is declined with an expired_card code. You can use any valid expiry and CVC code # Authentication Briqpay utilizes JWT in order to authenticate calls to our platform. Authentication tokens expire after 48 hours, and at that point you can generate a new token for the given resource using the ``/auth`` endpoint. - Basic Auth - only used on the auth endpoint in order to get the Bearer Token - JWT Bearer Token - All calls towards the API utlizes this method"

phpcuong/magento2-redirect-customer

35 Downloads

Redirect Customer to the particular page after Logging in successfully

eciboadaptech/finapi-access

353 Downloads

RESTful API for Account Information Services (AIS) and Payment Initiation Services (PIS) Application Version: 2.29.4 The following pages give you some general information on how to use our APIs. The actual API services documentation then follows further below. You can use the menu to jump between API sections. This page has a built-in HTTP(S) client, so you can test the services directly from within this page, by filling in the request parameters and/or body in the respective services, and then hitting the TRY button. Note that you need to be authorized to make a successful API call. To authorize, refer to the 'Authorization' section of the API, or just use the OAUTH button that can be found near the TRY button. General information Error Responses When an API call returns with an error, then in general it has the structure shown in the following example: { "errors": [ { "message": "Interface 'FINTS_SERVER' is not supported for this operation.", "code": "BAD_REQUEST", "type": "TECHNICAL" } ], "date": "2020-11-19T16:54:06.854+01:00", "requestId": "selfgen-312042e7-df55-47e4-bffd-956a68ef37b5", "endpoint": "POST /api/v2/bankConnections/import", "authContext": "1/21", "bank": "DEMO0002 - finAPI Test Redirect Bank (id: 280002, location: none)" } If an API call requires an additional authentication by the user, HTTP code 510 is returned and the error response contains the additional "multiStepAuthentication" object, see the following example: { "errors": [ { "message": "Es ist eine zusätzliche Authentifizierung erforderlich. Bitte geben Sie folgenden Code an: 123456", "code": "ADDITIONAL_AUTHENTICATION_REQUIRED", "type": "BUSINESS", "multiStepAuthentication": { "hash": "678b13f4be9ed7d981a840af8131223a", "status": "CHALLENGE_RESPONSE_REQUIRED", "challengeMessage": "Es ist eine zusätzliche Authentifizierung erforderlich. Bitte geben Sie folgenden Code an: 123456", "answerFieldLabel": "TAN", "redirectUrl": null, "redirectContext": null, "redirectContextField": null, "twoStepProcedures": null, "photoTanMimeType": null, "photoTanData": null, "opticalData": null, "opticalDataAsReinerSct": false } } ], "date": "2019-11-29T09:51:55.931+01:00", "requestId": "selfgen-45059c99-1b14-4df7-9bd3-9d5f126df294", "endpoint": "POST /api/v2/bankConnections/import", "authContext": "1/18", "bank": "DEMO0001 - finAPI Test Bank" } An exception to this error format are API authentication errors, where the following structure is returned: { "error": "invalid_token", "error_description": "Invalid access token: cccbce46-xxxx-xxxx-xxxx-xxxxxxxxxx" } Paging API services that may potentially return a lot of data implement paging. They return a limited number of entries within a "page". Further entries must be fetched with subsequent calls. Any API service that implements paging provides the following input parameters: • "page": the number of the page to be retrieved (starting with 1). • "perPage": the number of entries within a page. The default and maximum value is stated in the documentation of the respective services. A paged response contains an additional "paging" object with the following structure: { ... , "paging": { "page": 1, "perPage": 20, "pageCount": 234, "totalCount": 4662 } } Internationalization The finAPI services support internationalization which means you can define the language you prefer for API service responses. The following languages are available: German, English, Czech, Slovak. The preferred language can be defined by providing the official HTTP Accept-Language header. finAPI reacts on the official iso language codes "de", "en", "cs" and "sk" for the named languages. Additional subtags supported by the Accept-Language header may be provided, e.g. "en-US", but are ignored. If no Accept-Language header is given, German is used as the default language. Exceptions: • Bank login hints and login fields are only available in the language of the bank and not being translated. • Direct messages from the bank systems typically returned as BUSINESS errors will not be translated. • BUSINESS errors created by finAPI directly are available in German and English. • TECHNICAL errors messages meant for developers are mostly in English, but also may be translated. Request IDs With any API call, you can pass a request ID via a header with name "X-Request-Id". The request ID can be an arbitrary string with up to 255 characters. Passing a longer string will result in an error. If you don't pass a request ID for a call, finAPI will generate a random ID internally. The request ID is always returned back in the response of a service, as a header with name "X-Request-Id". We highly recommend to always pass a (preferably unique) request ID, and include it into your client application logs whenever you make a request or receive a response (especially in the case of an error response). finAPI is also logging request IDs on its end. Having a request ID can help the finAPI support team to work more efficiently and solve tickets faster. Overriding HTTP methods Some HTTP clients do not support the HTTP methods PATCH or DELETE. If you are using such a client in your application, you can use a POST request instead with a special HTTP header indicating the originally intended HTTP method. The header's name is X-HTTP-Method-Override. Set its value to either PATCH or DELETE. POST Requests having this header set will be treated either as PATCH or DELETE by the finAPI servers. Example: X-HTTP-Method-Override: PATCH POST /api/v2/label/51 {"name": "changed label"} will be interpreted by finAPI as: PATCH /api/v2/label/51 {"name": "changed label"} User metadata With the migration to PSD2 APIs, a new term called "User metadata" (also known as "PSU metadata") has been introduced to the API. This user metadata aims to inform the banking API if there was a real end-user behind an HTTP request or if the request was triggered by a system (e.g. by an automatic batch update). In the latter case, the bank may apply some restrictions such as limiting the number of HTTP requests for a single consent. Also, some operations may be forbidden entirely by the banking API. For example, some banks do not allow issuing a new consent without the end-user being involved. Therefore, it is certainly necessary and obligatory for the customer to provide the PSU metadata for such operations. As finAPI does not have direct interaction with the end-user, it is the client application's responsibility to provide all the necessary information about the end-user. This must be done by sending additional headers with every request triggered on behalf of the end-user. At the moment, the following headers are supported by the API: • "PSU-IP-Address" - the IP address of the user's device. It has to be an IPv4 address, as some banks cannot work with IPv6 addresses. If a non-IPv4 address is passed, we will replace the value with our own IPv4 address as a fallback. • "PSU-Device-OS" - the user's device and/or operating system identification. • "PSU-User-Agent" - the user's web browser or other client device identification. FAQ Is there a finAPI SDK? Currently we do not offer a native SDK, but there is the option to generate an SDK for almost any target language via OpenAPI. Use the 'Download SDK' button on this page for SDK generation. How can I enable finAPI's automatic batch update? Currently there is no way to set up the batch update via the API. Please contact [email protected] for this. Why do I need to keep authorizing when calling services on this page? This page is a "one-page-app". Reloading the page resets the OAuth authorization context. There is generally no need to reload the page, so just don't do it and your authorization will persist.

reillo/customerredirect

30 Downloads

Magento (1.9.x) - Redirect customer group to specific store url after login.

genesisoft/redirectcustomer

3 Downloads

Redireciona o Cliente para o Checkout após registro quando há produto no carrinho

mimou78/magento-2-mail-redirect

5 Downloads

This module allows you to redirect all emails that leave Magento to a specific email. and this in order to prevent customers during the development period from receiving test emails.

magezil/module-site-restrict

0 Downloads

Custom Module to redirect to login or forgot password if customer is not logged in.

kruegge82/jtlffn

5 Downloads

# Introduction JTL-FFN is a standardized interface for fulfillment service providers and their customers. Fulfiller can offer their services to merchants and merchants can respectively choose from a wide range of service providers according to their needs. ## The ecosystem The FFN network consists of this REST API, an online portal and third party integrations (JTL-Wawi being one of them). The REST API orchestrates the interactions between the participants and the portal website provides services by JTL (such as managing and certifying warehouses of a fulfiller and merchants searching for their service providers). ## About this API The base url of this api is [https://ffn2.api.jtl-software.com/api](https://ffn2.api.jtl-software.com/api). This API (and this documentation) consists of three parts: * Fulfiller API - operations used when acting as a fulfiller in the network. Only users with the role `Fulfiller` can access these endpoints. * Merchant API - operations used when acting as a merchant in the network. Only users with the role `Merchant` can access these endpoints. * Shared API - operations available to all users. Please use the navigation menu at the top to switch between the documentation for the different APIs. # OAuth The FFN-API uses [OAuth2](https://tools.ietf.org/html/rfc6749) with the [Authorization Code Grant](https://tools.ietf.org/html/rfc6749#section-4.1) for its endpoints. Users must have an active [JTL customer center](https://kundencenter.jtl-software.de) account to authorize against the OAuth2 server. Applications and services using the API must acquire client credentials from JTL. ## Application credentials When making calls against the API, you need to do it in the context of an application. You will get the credentials for your application from JTL. Application credentials consist of the following: * `client_id` - uniquely identifies your application * `client_secret` - secret used to authenticate your application * `callback_uri` - the uri the OAuth2 server redirect to on authorization requests ## Requesting authorization When you want to authorize a user you redirect him to `https://oauth2.api.jtl-software.com/authorize` with the following query string parameters: * `response_type` - Must be set to "code" for the [Authorization Code Grant](https://tools.ietf.org/html/rfc6749#section-4.1). * `redirect_uri` - After the user accepts your authorization request this is the url that will be redirected to. It must match the `callback_uri` in your client credentials. * `client_id` - Your applications identifier from your application credentials. * `scope` - The scopes you wish to authorize (space delimited). * `state` - An opaque value that will be included when redirecting back after the user accepts the authorisation. This is not required, but is important for [security considerations](http://www.thread-safe.com/2014/05/the-correct-use-of-state-parameter-in.html). After successful authorization by the user, the OAuth2 server will redirect back to your applications callback with the following query string parameters: * `code` - The authorization code. * `state` - The state parameter that was sent in the request. ## Verifying authorization The authorization code you acquired in the last step will now be exchanged for an access token. In order to do this you need to POST a request to `https://oauth2.api.jtl-software.com/token`. >POST > >Authorization: Basic `application_basic_auth`\ >Content-Type: application/x-www-form-urlencoded > >grant_type=authorization_code&code=`code`&redirect_uri=`redirect_uri` In the Authorization header [Basic HTTP authentication](https://tools.ietf.org/html/rfc7617) is used. Your application credentials `client_id` will be used as the username and your `client_secret` as the password. The header should have the value "Basic" plus the Base64 encoded string comprising of `client_id:client_secret`. The body of the request consist of the form encoded parameters: * `grant_type` - Must be set to "authorization_code". * `code` - The authorization code received from the previous step. * `redirect_uri` - Must match the `callback_uri` in your client credentials. A successful verification request will return a JSON response with the properties: * `token_type` - is always "Bearer" * `expires_in` - the time in seconds until the access token will expire * `access_token` - the access token used for API requests * `refresh_token` - token used to get a new access_token without needing to ask the user again Now the APIs endpoints that need authorization can be called by setting the header >Authorization: Bearer `access_token` ## Refreshing authorization To get a new `access_token` (for example when the old one expired) one can POST a request to `https://oauth2.api.jtl-software.com/token`. >POST > >Authorization: Basic `application_basic_auth`\ >Content-Type: application/x-www-form-urlencoded > >grant_type=refresh_token&refresh_token=`refresh_token` The Basic HTTP Authorization works exactly as in the verification step. The body of the request consist of the form encoded parameters: * `grant_type` - Must be set to "refresh_token". * `refresh_token` - The `refresh_token` you acquired during verification. The response will be the same as in the verification step. ## Scopes Scopes allow fine grained control over what actions are allowed for a given application. During login users must approve the requested scopes, so it is often feasible to limit asking for permissions your application really needs. Global scopes for common permission scenarios are the following: * `ffn.fulfiller.read` - full read access for the fulfiller API * `ffn.fulfiller.write` - full write access for the fulfiller API * `ffn.merchant.read` - full read access for the merchant API * `ffn.merchant.write` - full write access for the merchant API More fine grained scopes can be acquired from each respective endpoints documentation. ## Example ### Prerequsites * JTL Customer center account (https://kundencenter.jtl-software.de/) * cUrl (https://curl.se/) * FFN portal account (just login here: https://fulfillment.jtl-software.com) * FFN portal sandbox account (if you want to test on sandbox: https://fulfillment-sandbox.jtl-software.com) * Oauth Client for authorization and define scopes Values in this example (access_token, refresh_token, code...) are expired and cannot be used verbatim. ### Step 1 - Create an OAuth client Navigate to https://kundencenter.jtl-software.de/oauth and create a new OAuth client. (You can´t navigate to Oauth in customer account, you should use this link, or you can change logged in index to oauth) !Templates define what scopes are possible for this client. scopes with access rights: * ffn.merchant.read - full read access for the fulfiller API * ffn.merchant.write - full write access for the fulfiller API * ffn.fulfiller.read - full read access for the merchant API * ffn.fulfiller.write - full write access for the merchant API More fine grained scopes can be acquired from each respective endpoints documentation.  Overview: clients, scopes, client-secret and client-id  In our example: * client_id: 97170e65-d390-4633-ba46-d6ghef8222de * client_secret: f364ldUw3wGJFGn3JXE2NpGdCvUSMlmK72gsYg1z * redirect_uri: http://localhost:53972/ffn/sso The values for this client should not be used in production and are for testing only. ### Step 2 - User login In this step you will redirect the user to the JTL OAuth website using his default browser. Here the user will provide his username/password and accept the requested scopes. Finally the JTL Oauth website will redirect to the provided redirect_uri and provide the code. Template: authorize specified scopes and get code answer to request the access token ``` https://oauth2.api.jtl-software.com/authorize?response_type=code&redirect_uri=[redirect_uri]&client_id=[client_id]&scope=[scopes] ``` Note: the scopes should be seperated by spaces or %20 Filled with our example values: ``` https://oauth2.api.jtl-software.com/authorize?response_type=code&redirect_uri=http://localhost:53972/ffn/sso/oauth&client_id=97170e65-d390-4633-ba46-d6ghef8222de&scope=ffn.merchant.read%20ffn.merchant.write ``` * enter password  * authorize scopes  * code answer from server  Example of the answer from the OAuth server to our redirect_uri: ``` http://localhost:53972/ffn/sso?code=def50200f3ac7aabbb6e82a6b131874115b858549dab62e73c68ea21a03de59b5744dc0f0ee321d7607062cf9bfa57471cd0ee7572db1d7b0a15779b0dda7d0ed8f8bfdb0f69939a34678d67aee41e4849d355d8aa223733ab1f397280b205fa739c6252d77d9ff600136e1b744352115fd62ba1035d8da4cbc1b6791c61d0bb621952b0a14625dd75807113ea0746e35528c304a8ce3c06724c1e1d9e1cb3709e9f52778bc8ca5b2d8f7c055f14244b1f8fcb61554c5bf48e02b882b87b9a76a43579eecd578cec97c6f603907e282e45cfec43837c063dc36b556d4974776a942f47cee19023e130ae852bfca6d3ca9c7cb3283d2bc4971f80651b626f8e7ba0ec2d13dddc4c528e1f3e470de907af7eb304d781534dd9b071d9760c9890e5756893c7800589c407bd2da3a2ff56c3fb15a410e24aa2df7ac54e8d0f7445e38e390171b58a0b66b337057d59acd29ed5bbc4df6bee921b244f030c86f49bcae21c9ca77c05eea0094414803f30089c39d585bf83604a2d9bbcc6442fbfdcff6cca946eb84d1eac2e4f98dff31a93460c951c853f9ef7140f572be963e82a3baf72afba34572af63ee7da ``` Extract the code and note it for next steps. ### Step 3 - Get an access_token from the code Template: get access token + refresh token ``` curl --location --request POST "https://oauth2.api.jtl-software.com/token" --header "Content-Type: application/x-www-form-urlencoded" -u "[client_id]:[client_secret]" --data-urlencode "grant_type=authorization_code" --data-urlencode "redirect_uri=[redirect_uri]" --data-urlencode "code=[code]" ``` Filled with our example values: ``` curl --location --request POST "https://oauth2.api.jtl-software.com/token" --header "Content-Type: application/x-www-form-urlencoded" -u "97170e64-d390-4696-ba46-d6fcef8207de:f364ldUw3wIJFGn3JXE2NpGdAvUSMlmK72gsYg1z" --data-urlencode "grant_type=authorization_code" --data-urlencode "redirect_uri=http://localhost:49420/oauth" --data-urlencode "code=def50200e6f3c65cfaba9419cbf6e48a7ed4324ef851b0ace493213884496b851fd825b90b4f994ee265a62f2358bbcbb0f990af5dbfd93dc63e51a7a6fa3bcfc7f722f56366b0a726fd1ed5df1cb926b16610fc7beb0f236e8858e86397422e3caa75d8094af8ba8ad6a93b938bd341bec1e4df671ad71ad1d5fa41166f5d4b2a3ac7d9172c35a8501f10ad722ec2aea88439c21b148ec2ba85e93c17acebe7d7f3d0118a50941cab145ed5ce92946426e5d388584556c0b010c567b433c577a1c4f7b1dfb2c99c25a0efadece4f64f19e54305bfc591e2b30b1a7ba1a33af3e039bcfa80b21ca365dc003f07989fca92472c2c8e2daab51151624a6a10bc511f2ed586f06544f7b98566df4667f5bbd6ba7c6707cb673c767c9eab5a74e63a8269688941c3158e8cc1cb5ebe9a8aa468faf415171a481ee1489b58bedb5fc329b23e0e34e76a4a500270fbebe4e1d20a0f17cebc96cd8ab3db383af746ca0699da34b4665afad30e9dde4f5f507a1dd14c73a692f06de8bafe3be81d7744dbcd8c5f7d3c767101ff5ce0556c244130c1c3fc3f53975a841c0cacebb70118f7552f50c2d2b1c421b8a21e" ``` The result will be a JSON answer with the users access_token and refresh_token as well as the expiry in seconds. ``` { "token_type":"Bearer", "expires_in":1800, "access_token":"eyJ0eXAiOiJKV1QiLCJhbGciOiJSUzI1NiJ9. eyJhdWQiOiI5NzE3MGU2NC1kMzkwLTQ2OTYtYmE0Ni1kNmZjZWY4MjA3ZGUiLCJqdGkiOiJlOWVhN2Q0MWI1NDIzNTcyYWU0MDEzYjEzMDZiMGRkNWM3YmQ2ZTNjMDNhYTZmNjQ2M2NlMjUzNTc0ZmUyMWE3NGQyNTIyMTJhODQwMmI1ZCIsImlhdCI6MTY2MTI1MzE0OCwibmJmIjoxNjYxMjUzMTQ4LCJleHAiOjE2NjEyNTQ5NDgsInN1YiI6IjQ2MjA5Iiwic2NvcGVzIjpbImZmbi5tZXJjaGFudC5yZWFkIiwiZmZuLm1lcmNoYW50LndyaXRlIl19.eEwY021wR3BWVp-wbAVQrjfqwFbYqLlOV_ca-cb7-O3Kdpi8mkFQBxfI8rzSiV_1WpAINf4ydV9FR9Ty992SMiAqGJ3T9zDHd68oUDePeq7Xfafp-87UboI2mCfGd7518CoKVLqg5ohb4YCqgC7Dz588FofggCQyDZQSM-8raOgcM-pJ1TT7oRuYuDHsOzCOTPcX2YiGYKCc3M6kxlBy_NjrJoLa4qysLRmPkznWwj0caC7a0VJO5KubvECcMb9D7Byr3UNjI7GiGMAufa770V5qCjrWs4gOsRV-Bn7oQydvsL21qqjBKHcssQrlLZWmrcfKqgBKwfRXIx3Mu5HBCmtHjHMnuvPVEZAj6fEfIwjYSeTAHTHApEwbE7J1MPd8MU0K6X2YEUF315fXN5F3rO3ZL5FdTwcM1E-1-PKubLuMAaE6Lw-QsDtBoI4ESylomCmCCfgLV4Vj-in_oCJUmKXAX0tDSa9y9vb6oAExung_BTJCBemffCtkJ55Px7bvi9JXmwvI0pIFo3QzTUtRbFDizCMrPZvsatFx64mXX3IDoVqXr3uzvdetBIJEj2ngVdGRrKGt4Yboae5oFV2d5jdSZBL28pwGjey__ZB4zLR1DodQ0sOqDWJ3WsEjMYXU8_-IGrS8Kkw8Q0R0UqqyVLfcLr-cfH5tYqf2QLqAScY","refresh_token":"def50200e636703f8d6372401e7b5e1163e0f46e5d593f6f8a1e9b1b2777d64684b87b7c552db62f9670bc482a3958d8aafb78083c7166c13f2f233fe4623d22873c819a560dc3213a51448a1e0763c2a0f7fb7230ceeae22a7fa84717458886584ab5a0ed1a500be5f9d3ed36b1d063d39b56c8431f3fe623055626c1f99f8c5b684853965645fe5c5bee941857aef79ae4f9b994316bec9d365119fe0fe8d035218c44d00a47c0e92b4613c1f388b9c171f3d79e45a6d2a52dfbd8d25608d6b0350420155e48cc179764a2432220cc0d1e9bfa7798050d0b36fe658e967186ea75cc1d1277cad973d43a0839c50b6885a87b5b446452855a00ac75c5f6d7f62b914496e30ab89a16b335977e4363b94dda7364bb052832a5d122696b6476fb0e1631030ea3c42d9659ca839cc44919efc9532c84f7170e634d3e189eb181d0c114ed9d8150c619f7567587e0311d89d51d1325646d2c014757ba7f2d7b02f7b56a52e093ed2ea95a8abe4a0289b24a5636dce8ad01c20e8cce8c4c51263e7f1731bb6335b0e31342e2439c77ab7cce7a147e24c9be9d61d8eba216fbfd4d5be2fba3502e69000ad6e67b7230a7f924" } ``` ### Step 4 - Test the access_token Using your newly aquired access_token you can test if its working (reminder: the access_token has a limited lifetime and might be expired, in which case we would need to refresh it (see Step 5)). Template: Test communication with access token on sandbox or production (our client is for both systems) ``` curl --location --request GET "https://ffn-sbx.api.jtl-software.com/api/v1/users/current" --header "Authorization: Bearer [access_token]" ``` If you cannot retrieve the user data using this endpoint make sure you have logged into our respective portal website (sandbox, production) at least once as this triggers user creation in the system. ### Step 5 - Refresh access_token when it expires Template: Get a new access token + refresh token with the refresh token ``` curl --location --request POST "https://oauth2.api.jtl-software.com/token" --header "Content-Type: application/x-www-form-urlencoded" -u "[client_id]:[client_secret]" --data-urlencode "grant_type=refresh_token" --data-urlencode "refresh_token=[refresh_token]" ``` Filled with our example values: ``` curl --location --request POST "https://oauth2.api.jtl-software.com/token" --header "Content-Type: application/x-www-form-urlencoded" -u "97170e64-d390-4696-ba46-d6fcef8207de:f364ldUw3wIJFGn3JXE2NpGdAvUSMlmK72gsYg1z" --data-urlencode "grant_type=refresh_token" --data-urlencode "refresh_token=def50200a01c0caff50b7db271f8268e3806ab2cce8e28e25f41e5fe9167a6521b47f6ed0dd3dd2d7856e1983ae645b032cf9285e91c1ee535decb0e0ca3e52670773f2737114955267d83db0204f80233214a623fcc36de04127e1cdcda006eaf60cacfb30c80081a8c9314e20117f64639ab5e333301a10173385c1bfc660709fde0b1a3517f8030dfdba8187e53c23c9d5fe9f33c48e11a4aa41bfd9ea1291507ea1bc8c64df32bdc91c61af907c41cf0bb305cae76e68448a85ad65b0a03a23ec35a7e9cc42aadd0792b9d7d187ae028e2759a7f4a0164f94d9baca29779a702f023216631e1e777069cc2bc65fd404f4fcc5818219063beb1717afe159b8110394af9a0d245de960c227b1183d6a745819ac08d92238938da798f702f83a3faf648f07a8a6d1e694c008517fd8be2fa154aab88a3eaacb3cbb1830c4bdee018e06c7f81e68c5844213f1d02372b23a22d99ac06a860748a3db891fd71768d74470c9a5a8571058dd901c888d13cd4481d63a800322614e63d3d8e6fb109ee7e1b1e046cd086ecbc2d4d362ca662e3ac867f21168833abd7a8247b06602197b7da555361efbf07b0afed69f7a558" ``` The result will be the same format as in step 3. Refresh_tokens are only valid for a single refresh and you will get a new refresh_token every single time that you must persist. ### My token is not working! #### 404 NotFound You need to log into the respective portal website (sandbox-https://fulfillment-sandbox.jtl-software.com, production-https://fulfillment.jtl-software.com) at least once to trigger user creation. #### 403 Forbidden You might be missing scopes in your token and don't have sufficient rights. #### 401 Forbidden Incorrect Oauth method. For example, we do not support the Oauth method authorisation "client_credentials grant". The authorisation method "code grant" with user must be used.

bank-io/bankio-sdk-php

106 Downloads

# Summary The **NextGenPSD2** *Framework Version 1.3.6* (with errata) offers a modern, open, harmonised and interoperable set of Application Programming Interfaces (APIs) as the safest and most efficient way to provide data securely. The NextGenPSD2 Framework reduces XS2A complexity and costs, addresses the problem of multiple competing standards in Europe and, aligned with the goals of the Euro Retail Payments Board, enables European banking customers to benefit from innovative products and services ('Banking as a Service') by granting TPPs safe and secure (authenticated and authorised) access to their bank accounts and financial data. The possible Approaches are: * Redirect SCA Approach * OAuth SCA Approach * Decoupled SCA Approach * Embedded SCA Approach without SCA method * Embedded SCA Approach with only one SCA method available * Embedded SCA Approach with Selection of a SCA method Not every message defined in this API definition is necessary for all approaches. Furthermore this API definition does not differ between methods which are mandatory, conditional, or optional. Therefore for a particular implementation of a Berlin Group PSD2 compliant API it is only necessary to support a certain subset of the methods defined in this API definition. **Please have a look at the implementation guidelines if you are not sure which message has to be used for the approach you are going to use.** ## Some General Remarks Related to this version of the OpenAPI Specification: * **This API definition is based on the Implementation Guidelines of the Berlin Group PSD2 API.** It is not a replacement in any sense. The main specification is (at the moment) always the Implementation Guidelines of the Berlin Group PSD2 API. * **This API definition contains the REST-API for requests from the PISP to the ASPSP.** * **This API definition contains the messages for all different approaches defined in the Implementation Guidelines.** * According to the OpenAPI-Specification [https://github.com/OAI/OpenAPI-Specification/blob/master/versions/3.0.1.md] "If in is "header" and the name field is "Accept", "Content-Type" or "Authorization", the parameter definition SHALL be ignored." The element "Accept" will not be defined in this file at any place. The elements "Content-Type" and "Authorization" are implicitly defined by the OpenApi tags "content" and "security". * There are several predefined types which might occur in payment initiation messages, but are not used in the standard JSON messages in the Implementation Guidelines. Therefore they are not used in the corresponding messages in this file either. We added them for the convenience of the user. If there is a payment product, which needs these fields, one can easily use the predefined types. But the ASPSP need not to accept them in general. * **We omit the definition of all standard HTTP header elements (mandatory/optional/conditional) except they are mentioned in the Implementation Guidelines.** Therefore the implementer might add these in his own realisation of a PSD2 comlient API in addition to the elements defined in this file. ## General Remarks on Data Types The Berlin Group definition of UTF-8 strings in context of the PSD2 API has to support at least the following characters a b c d e f g h i j k l m n o p q r s t u v w x y z A B C D E F G H I J K L M N O P Q R S T U V W X Y Z 0 1 2 3 4 5 6 7 8 9 / - ? : ( ) . , ' + Space

affixapi/api

13 Downloads

The affixapi.com API documentation. # Introduction Affix API is an OAuth 2.1 application that allows developers to access customer data, without developers needing to manage or maintain integrations; or collect login credentials or API keys from users for these third party systems. # OAuth 2.1 Affix API follows the [OAuth 2.1 spec](https://datatracker.ietf.org/doc/html/draft-ietf-oauth-v2-1-08). As an OAuth application, Affix API handles not only both the collection of sensitive user credentials or API keys, but also builds and maintains the integrations with the providers, so you don't have to. # How to obtain an access token in order to get started, you must: - register a `client_id` - direct your user to the sign in flow (`https://connect.affixapi.com` [with the appropriate query parameters](https://github.com/affixapi/starter-kit/tree/master/connect)) - capture `authorization_code` we will send to your redirect URI after the sign in flow is complete and exchange that `authorization_code` for a Bearer token # Sandbox keys (xhr mode) ### dev ``` eyJhbGciOiJFUzI1NiIsImtpZCI6Ims5RmxwSFR1YklmZWNsUU5QRVZzeFcxazFZZ0Zfbk1BWllOSGVuOFQxdGciLCJ0eXAiOiJKV1MifQ.eyJwcm92aWRlciI6InNhbmRib3giLCJzY29wZXMiOlsiLzIwMjMtMDMtMDEveGhyL2NvbXBhbnkiLCIvMjAyMy0wMy0wMS94aHIvZW1wbG95ZWUiLCIvMjAyMy0wMy0wMS94aHIvZW1wbG95ZWVzIiwiLzIwMjMtMDMtMDEveGhyL2dyb3VwcyIsIi8yMDIzLTAzLTAxL3hoci9pZGVudGl0eSIsIi8yMDIzLTAzLTAxL3hoci9wYXlydW5zIiwiLzIwMjMtMDMtMDEveGhyL3BheXJ1bnMvOnBheXJ1bl9pZCIsIi8yMDIzLTAzLTAxL3hoci90aW1lLW9mZi1iYWxhbmNlcyIsIi8yMDIzLTAzLTAxL3hoci90aW1lLW9mZi1lbnRyaWVzIiwiLzIwMjMtMDMtMDEveGhyL3RpbWVzaGVldHMiLCIvMjAyMy0wMy0wMS94aHIvd29yay1sb2NhdGlvbnMiXSwidG9rZW4iOiIzODIzNTNlMi05N2ZiLTRmMWEtOTYxYy0zZDI5OTViNzYxMTUiLCJpYXQiOjE3MTE4MTA3MTQsImlzcyI6InB1YmxpY2FwaS1pbnRlcm1lZGlhdGUuZGV2LmVuZ2luZWVyaW5nLmFmZml4YXBpLmNvbSIsInN1YiI6InhociIsImF1ZCI6IjNGREFFREY5LTFEQ0E0RjU0LTg3OTQ5RjZBLTQxMDI3NjQzIn0.zUJPaT6IxcIdr8b9iO6u-Rr5I-ohTHPYTrQGrgOFghbEbovItiwr9Wk479GnJVJc3WR8bxAwUMAE4Ul6Okdk6Q ``` #### `employees` endpoint sample: ``` curl --fail \ -X GET \ -H 'Authorization: Bearer eyJhbGciOiJFUzI1NiIsImtpZCI6Ims5RmxwSFR1YklmZWNsUU5QRVZzeFcxazFZZ0Zfbk1BWllOSGVuOFQxdGciLCJ0eXAiOiJKV1MifQ.eyJwcm92aWRlciI6InNhbmRib3giLCJzY29wZXMiOlsiLzIwMjMtMDMtMDEveGhyL2NvbXBhbnkiLCIvMjAyMy0wMy0wMS94aHIvZW1wbG95ZWUiLCIvMjAyMy0wMy0wMS94aHIvZW1wbG95ZWVzIiwiLzIwMjMtMDMtMDEveGhyL2dyb3VwcyIsIi8yMDIzLTAzLTAxL3hoci9pZGVudGl0eSIsIi8yMDIzLTAzLTAxL3hoci9wYXlydW5zIiwiLzIwMjMtMDMtMDEveGhyL3BheXJ1bnMvOnBheXJ1bl9pZCIsIi8yMDIzLTAzLTAxL3hoci90aW1lLW9mZi1iYWxhbmNlcyIsIi8yMDIzLTAzLTAxL3hoci90aW1lLW9mZi1lbnRyaWVzIiwiLzIwMjMtMDMtMDEveGhyL3RpbWVzaGVldHMiLCIvMjAyMy0wMy0wMS94aHIvd29yay1sb2NhdGlvbnMiXSwidG9rZW4iOiIzODIzNTNlMi05N2ZiLTRmMWEtOTYxYy0zZDI5OTViNzYxMTUiLCJpYXQiOjE3MTE4MTA3MTQsImlzcyI6InB1YmxpY2FwaS1pbnRlcm1lZGlhdGUuZGV2LmVuZ2luZWVyaW5nLmFmZml4YXBpLmNvbSIsInN1YiI6InhociIsImF1ZCI6IjNGREFFREY5LTFEQ0E0RjU0LTg3OTQ5RjZBLTQxMDI3NjQzIn0.zUJPaT6IxcIdr8b9iO6u-Rr5I-ohTHPYTrQGrgOFghbEbovItiwr9Wk479GnJVJc3WR8bxAwUMAE4Ul6Okdk6Q' \ 'https://dev.api.affixapi.com/2023-03-01/xhr/employees' ``` ### prod ``` eyJhbGciOiJFUzI1NiIsImtpZCI6Ims5RmxwSFR1YklmZWNsUU5QRVZzeFcxazFZZ0Zfbk1BWllOSGVuOFQxdGciLCJ0eXAiOiJKV1MifQ.eyJwcm92aWRlciI6InNhbmRib3giLCJzY29wZXMiOlsiLzIwMjMtMDMtMDEveGhyL2NvbXBhbnkiLCIvMjAyMy0wMy0wMS94aHIvZW1wbG95ZWUiLCIvMjAyMy0wMy0wMS94aHIvZW1wbG95ZWVzIiwiLzIwMjMtMDMtMDEveGhyL2dyb3VwcyIsIi8yMDIzLTAzLTAxL3hoci9pZGVudGl0eSIsIi8yMDIzLTAzLTAxL3hoci9wYXlydW5zIiwiLzIwMjMtMDMtMDEveGhyL3BheXJ1bnMvOnBheXJ1bl9pZCIsIi8yMDIzLTAzLTAxL3hoci90aW1lLW9mZi1iYWxhbmNlcyIsIi8yMDIzLTAzLTAxL3hoci90aW1lLW9mZi1lbnRyaWVzIiwiLzIwMjMtMDMtMDEveGhyL3RpbWVzaGVldHMiLCIvMjAyMy0wMy0wMS94aHIvd29yay1sb2NhdGlvbnMiXSwidG9rZW4iOiIzYjg4MDc2NC1kMGFmLTQ5ZDAtOGM5OS00YzIwYjE2MTJjOTMiLCJpYXQiOjE3MTE4MTA4NTgsImlzcyI6InB1YmxpY2FwaS1pbnRlcm1lZGlhdGUucHJvZC5lbmdpbmVlcmluZy5hZmZpeGFwaS5jb20iLCJzdWIiOiJ4aHIiLCJhdWQiOiIwOEJCMDgxRS1EOUFCNEQxNC04REY5OTIzMy02NjYxNUNFOSJ9.n3pJmmfegU21Tko_TyUyCHi4ITvfd75T8NFFTHmf1r8AI8yCUYTWdfNjyZZWcZD6z50I3Wsk2rAd8GDWXn4vlg ``` #### `employees` endpoint sample: ``` curl --fail \ -X GET \ -H 'Authorization: Bearer eyJhbGciOiJFUzI1NiIsImtpZCI6Ims5RmxwSFR1YklmZWNsUU5QRVZzeFcxazFZZ0Zfbk1BWllOSGVuOFQxdGciLCJ0eXAiOiJKV1MifQ.eyJwcm92aWRlciI6InNhbmRib3giLCJzY29wZXMiOlsiLzIwMjMtMDMtMDEveGhyL2NvbXBhbnkiLCIvMjAyMy0wMy0wMS94aHIvZW1wbG95ZWUiLCIvMjAyMy0wMy0wMS94aHIvZW1wbG95ZWVzIiwiLzIwMjMtMDMtMDEveGhyL2dyb3VwcyIsIi8yMDIzLTAzLTAxL3hoci9pZGVudGl0eSIsIi8yMDIzLTAzLTAxL3hoci9wYXlydW5zIiwiLzIwMjMtMDMtMDEveGhyL3BheXJ1bnMvOnBheXJ1bl9pZCIsIi8yMDIzLTAzLTAxL3hoci90aW1lLW9mZi1iYWxhbmNlcyIsIi8yMDIzLTAzLTAxL3hoci90aW1lLW9mZi1lbnRyaWVzIiwiLzIwMjMtMDMtMDEveGhyL3RpbWVzaGVldHMiLCIvMjAyMy0wMy0wMS94aHIvd29yay1sb2NhdGlvbnMiXSwidG9rZW4iOiIzYjg4MDc2NC1kMGFmLTQ5ZDAtOGM5OS00YzIwYjE2MTJjOTMiLCJpYXQiOjE3MTE4MTA4NTgsImlzcyI6InB1YmxpY2FwaS1pbnRlcm1lZGlhdGUucHJvZC5lbmdpbmVlcmluZy5hZmZpeGFwaS5jb20iLCJzdWIiOiJ4aHIiLCJhdWQiOiIwOEJCMDgxRS1EOUFCNEQxNC04REY5OTIzMy02NjYxNUNFOSJ9.n3pJmmfegU21Tko_TyUyCHi4ITvfd75T8NFFTHmf1r8AI8yCUYTWdfNjyZZWcZD6z50I3Wsk2rAd8GDWXn4vlg' \ 'https://api.affixapi.com/2023-03-01/xhr/employees' ``` # Compression We support `brotli`, `gzip`, and `deflate` compression algorithms. To enable, pass the `Accept-Encoding` header with one or all of the values: `br`, `gzip`, `deflate`, or `identity` (no compression) In the response, you will receive the `Content-Encoding` response header indicating the compression algorithm used in the data payload to enable you to decompress the result. If the `Accept-Encoding: identity` header was passed, no `Content-Encoding` response header is sent back, as no compression algorithm was used. # Webhooks An exciting feature for HR/Payroll modes are webhooks. If enabled, your `webhook_uri` is set on your `client_id` for the respective environment: `dev | prod` Webhooks are configured to make live requests to the underlying integration 1x/hr, and if a difference is detected since the last request, we will send a request to your `webhook_uri` with this shape: ``` { added: [ { ..., date_of_birth: '2010-08-06', display_full_name: 'Daija Rogahn', employee_number: '57993', employment_status: 'pending', employment_type: 'other', employments: [ { currency: 'eur', effective_date: '2022-02-25', employment_type: 'other', job_title: 'Dynamic Implementation Manager', pay_frequency: 'semimonthly', pay_period: 'YEAR', pay_rate: 96000, }, ], first_name: 'Daija', ... } ], removed: [], updated: [ { ..., date_of_birth: '2009-11-09', display_full_name: 'Lourdes Stiedemann', employee_number: '63189', employment_status: 'leave', employment_type: 'full_time', employments: [ { currency: 'gbp', effective_date: '2023-01-16', employment_type: 'full_time', job_title: 'Forward Brand Planner', pay_frequency: 'semimonthly', pay_period: 'YEAR', pay_rate: 86000, }, ], first_name: 'Lourdes', } ] } ``` the following headers will be sent with webhook requests: ``` x-affix-api-signature: ab8474e609db95d5df3adc39ea3add7a7544bd215c5c520a30a650ae93a2fba7 x-affix-api-origin: webhooks-employees-webhook user-agent: affixapi.com ``` Before trusting the payload, you should sign the payload and verify the signature matches the signature sent by the `affixapi.com` service. This secures that the data sent to your `webhook_uri` is from the `affixapi.com` server. The signature is created by combining the signing secret (your `client_secret`) with the body of the request sent using a standard HMAC-SHA256 keyed hash. The signature can be created via: - create an `HMAC` with your `client_secret` - update the `HMAC` with the payload - get the hex digest -> this is the signature Sample `typescript` code that follows this recipe: ``` import { createHmac } from 'crypto'; export const computeSignature = ({ str, signingSecret, }: { signingSecret: string; str: string; }): string => { const hmac = createHmac('sha256', signingSecret); hmac.update(str); const signature = hmac.digest('hex'); return signature; }; ``` While verifying the Affix API signature header should be your primary method of confirming validity, you can also whitelist our outbound webhook static IP addresses. ``` dev: - 52.210.169.82 - 52.210.38.77 - 3.248.135.204 prod: - 52.51.160.102 - 54.220.83.244 - 3.254.213.171 ``` ## Rate limits Open endpoints (not gated by an API key) (applied at endpoint level): - 15 requests every 1 minute (by IP address) - 25 requests every 5 minutes (by IP address) Gated endpoints (require an API key) (applied at endpoint level): - 40 requests every 1 minute (by IP address) - 40 requests every 5 minutes (by `client_id`) Things to keep in mind: - Open endpoints (not gated by an API key) will likely be called by your users, not you, so rate limits generally would not apply to you. - As a developer, rate limits are applied at the endpoint granularity. - For example, say the rate limits below are 10 requests per minute by ip. from that same ip, within 1 minute, you get: - 10 requests per minute on `/orders`, - another 10 requests per minute on `/items`, - and another 10 requests per minute on `/identity`, - for a total of 30 requests per minute.

adaptech/finapi-access

514 Downloads

RESTful API for Account Information Services (AIS) and Payment Initiation Services (PIS) The following pages give you some general information on how to use our APIs. The actual API services documentation then follows further below. You can use the menu to jump between API sections. This page has a built-in HTTP(S) client, so you can test the services directly from within this page, by filling in the request parameters and/or body in the respective services, and then hitting the TRY button. Note that you need to be authorized to make a successful API call. To authorize, refer to the 'Authorization' section of the API, or just use the OAUTH button that can be found near the TRY button. General information Error Responses When an API call returns with an error, then in general it has the structure shown in the following example: { "errors": [ { "message": "Interface 'FINTS_SERVER' is not supported for this operation.", "code": "BAD_REQUEST", "type": "TECHNICAL" } ], "date": "2020-11-19 16:54:06.854", "requestId": "selfgen-312042e7-df55-47e4-bffd-956a68ef37b5", "endpoint": "POST /api/v1/bankConnections/import", "authContext": "1/21", "bank": "DEMO0002 - finAPI Test Redirect Bank" } If an API call requires an additional authentication by the user, HTTP code 510 is returned and the error response contains the additional "multiStepAuthentication" object, see the following example: { "errors": [ { "message": "Es ist eine zusätzliche Authentifizierung erforderlich. Bitte geben Sie folgenden Code an: 123456", "code": "ADDITIONAL_AUTHENTICATION_REQUIRED", "type": "BUSINESS", "multiStepAuthentication": { "hash": "678b13f4be9ed7d981a840af8131223a", "status": "CHALLENGE_RESPONSE_REQUIRED", "challengeMessage": "Es ist eine zusätzliche Authentifizierung erforderlich. Bitte geben Sie folgenden Code an: 123456", "answerFieldLabel": "TAN", "redirectUrl": null, "redirectContext": null, "redirectContextField": null, "twoStepProcedures": null, "photoTanMimeType": null, "photoTanData": null, "opticalData": null } } ], "date": "2019-11-29 09:51:55.931", "requestId": "selfgen-45059c99-1b14-4df7-9bd3-9d5f126df294", "endpoint": "POST /api/v1/bankConnections/import", "authContext": "1/18", "bank": "DEMO0001 - finAPI Test Bank" } An exception to this error format are API authentication errors, where the following structure is returned: { "error": "invalid_token", "error_description": "Invalid access token: cccbce46-xxxx-xxxx-xxxx-xxxxxxxxxx" } Paging API services that may potentially return a lot of data implement paging. They return a limited number of entries within a "page". Further entries must be fetched with subsequent calls. Any API service that implements paging provides the following input parameters: • "page": the number of the page to be retrieved (starting with 1). • "perPage": the number of entries within a page. The default and maximum value is stated in the documentation of the respective services. A paged response contains an additional "paging" object with the following structure: { ... , "paging": { "page": 1, "perPage": 20, "pageCount": 234, "totalCount": 4662 } } Internationalization The finAPI services support internationalization which means you can define the language you prefer for API service responses. The following languages are available: German, English, Czech, Slovak. The preferred language can be defined by providing the official HTTP Accept-Language header. finAPI reacts on the official iso language codes "de", "en", "cs" and "sk" for the named languages. Additional subtags supported by the Accept-Language header may be provided, e.g. "en-US", but are ignored. If no Accept-Language header is given, German is used as the default language. Exceptions: • Bank login hints and login fields are only available in the language of the bank and not being translated. • Direct messages from the bank systems typically returned as BUSINESS errors will not be translated. • BUSINESS errors created by finAPI directly are available in German and English. • TECHNICAL errors messages meant for developers are mostly in English, but also may be translated. Request IDs With any API call, you can pass a request ID via a header with name "X-Request-Id". The request ID can be an arbitrary string with up to 255 characters. Passing a longer string will result in an error. If you don't pass a request ID for a call, finAPI will generate a random ID internally. The request ID is always returned back in the response of a service, as a header with name "X-Request-Id". We highly recommend to always pass a (preferably unique) request ID, and include it into your client application logs whenever you make a request or receive a response (especially in the case of an error response). finAPI is also logging request IDs on its end. Having a request ID can help the finAPI support team to work more efficiently and solve tickets faster. Overriding HTTP methods Some HTTP clients do not support the HTTP methods PATCH or DELETE. If you are using such a client in your application, you can use a POST request instead with a special HTTP header indicating the originally intended HTTP method. The header's name is X-HTTP-Method-Override. Set its value to either PATCH or DELETE. POST Requests having this header set will be treated either as PATCH or DELETE by the finAPI servers. Example: X-HTTP-Method-Override: PATCH POST /api/v1/label/51 {"name": "changed label"} will be interpreted by finAPI as: PATCH /api/v1/label/51 {"name": "changed label"} User metadata With the migration to PSD2 APIs, a new term called "User metadata" (also known as "PSU metadata") has been introduced to the API. This user metadata aims to inform the banking API if there was a real end-user behind an HTTP request or if the request was triggered by a system (e.g. by an automatic batch update). In the latter case, the bank may apply some restrictions such as limiting the number of HTTP requests for a single consent. Also, some operations may be forbidden entirely by the banking API. For example, some banks do not allow issuing a new consent without the end-user being involved. Therefore, it is certainly necessary and obligatory for the customer to provide the PSU metadata for such operations. As finAPI does not have direct interaction with the end-user, it is the client application's responsibility to provide all the necessary information about the end-user. This must be done by sending additional headers with every request triggered on behalf of the end-user. At the moment, the following headers are supported by the API: • "PSU-IP-Address" - the IP address of the user's device. • "PSU-Device-OS" - the user's device and/or operating system identification. • "PSU-User-Agent" - the user's web browser or other client device identification. FAQ Is there a finAPI SDK? Currently we do not offer a native SDK, but there is the option to generate a SDK for almost any target language via OpenAPI. Use the 'Download SDK' button on this page for SDK generation. How can I enable finAPI's automatic batch update? Currently there is no way to set up the batch update via the API. Please contact [email protected] for this. Why do I need to keep authorizing when calling services on this page? This page is a "one-page-app". Reloading the page resets the OAuth authorization context. There is generally no need to reload the page, so just don't do it and your authorization will persist.

mestrona/magento-module-categoryredirect

39847 Downloads

Magento 2 Module to simply customize the menu with additional URLs: Create a category, enter the redirect, done.